In prior posts, I've argued against proposals in Maryland to raise the minimum wage to $10.10 per hour on the grounds that it will do significant damage to the employment prospects of young and unskilled workers - and not provide much actual help to the working poor.

What I've not made clear is that I do not oppose raising the minimum wage. In fact, I think a review of the history of the wage suggests that it should be raised to approximately $8.40 an hour and then indexed to inflation thereafter. But the proposal to make the MD minimum $10.10 by 2016 simply goes too far and would likely have significant negative effects on youth and unskilled employment levels. Those advocating the $10.10 an hour wage like to claim that had the minimum wage in the late 1960s simply kept pace with inflation the wage today would be well be roughly$10.50 per hour. Unfortunately, those folks are being intentionally misleading.

In fact, a new Congressional Budget Office report puts the lie to most of the claims made in support of the $10.10 minimum wage. According to the report, such a wage hike would result in the loss of 500,000 jobs. Though the wage hike would theoretically inject $31 billion dollars into the economy, only 19% of that would benefit families living in poverty while 29% would benefit families earning three times the poverty level or more - this is because most of those earning the minimum wage are not in poor working families. But the $31 billion figure is actually meaningless. The CBO estimates that 93% of the $31 billion would be negated by lost income to businesses, lost income from the resultant job loss, and lost income due to higher prices caused by the wage hike. In Maryland, Martin O’Malley has argued that a $10.10 minimum wage would pump $456 million into the Maryland economy, but if the CBO estimates are accurate, that $456 million would actually be less than $30 million owing to job loss, higher prices and lost business income. As an alternative, the CBO considered a $9 minimum wage as well and noted far fewer negative effects.

Are Minimum Wage Earners Young and Childless or Working Parents?

The other justification for the $10.10 per hour proposal is that it would raise the income of a family of four, with a single parent working full time, to the poverty level. But this a dubious goal. The average family size in American is 2.6, not 4. At a recent town hall meeting in southern Maryland Senator Ben Cardin offered some less than helpful statistics regarding those earning minimum wage. He said that roughly 2/3 are women and the average age of an earner is 35. His intent was clearly to create the impression that most minimum wage earners are single Moms. This is not the case. Roughly 1/3 of low income families are in house holds with a single adult.

As to the average age, the statistics shows why social scientists have three measures of central tendency, 1) the mean or simple average, 2) the median or value at which half the observations are above and half are below, and 3) the mode or the most frequently observed value. Though most people are familiar with concept of an average, the measure can present a skewed picture. Imagine 10 people, 9 of them have $10 and one of them has $1,000. Calculating the average cash on hand is easy - $1,090/10=$109. Clearly that is not an accurate accounting of the group. The median and modal values would be $10 - more accurate. So, back to minimum wage earners - consider the average age of 35 and a working life of 16-65 years of age. There are 19 measurable years between 16 and 35, but there are 30 measurable years between 35 and 65. Because our working life excludes our first 15 years of life, the simple average age of a minimum wage worker would skew "old." Consider how difficult it is to reconcile the average age with this fact: one-third of those earning the federal minimum wage are teens, and just over half of minimum wage earners are under the age of 25. If just over half are 25 of younger it suggests the median age is approximately 24 years old. And one final point, the vast majority of minimum wage earners are not the sole source of income for a family. So suddenly the image of minimum wage earners as single Moms disappears. It is true that about 1/4 of minimum wage earners fall into the category of parents with children - but it's inefficient and poor targeting to implement a 40% wage hike for the 75% of wage earners who are no parents supporting a family just to provide an income boost to 25% - and a recent piece in the Baltimore Sun demonstrated that as a result of the wage hike, many of those in that 25% would lose eligibility for social supports and wind up with less net income.

Would the Inflation Adjusted Wage Really Be over $10 per hour?

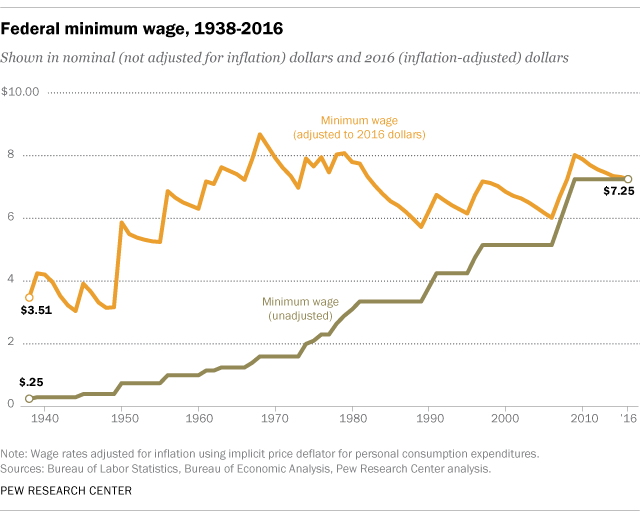

The following graph, courtesy of the unbiased folks at Pew, shows that the period from the late 1960s through at least 1981 were an unusually "generous" period for the minimum wage. But the period was far from the norm. If one were to select the late 1940s or the late 1950s as the basis for today's wage in would be far below $10.50, below $10.10, and below the current level of $7.25 - so claims of an inflation adjusted $10 minimum wage are simply disingenuous. In the end, none of the main arguments for a $10 wage hold up to serious scrutiny.

Should the Wage Be Higher?

There is a case to be made that the inflation-adjusted average wage for the "generous" period should serve as a baseline for the wage moving forward. Without question, a concerted effort was made to increase the purchasing power of the minimum wage throughout the 1960s and 70s before a long slide began in the 1980s through until 2009. Boosting the wage to the 1960s and 70s level would yield a minimum wage for 2015 of approximately $8.40 per hour. If it were then indexed to inflation and automatically adjusted every year thereafter it would no longer go through long periods of decline followed by sudden increases. As result, it would provided some degree of predictability in the value of the wage to workers and the cost of labor to employers.

In a prior post I cited a New York study that estimated a 20% jump in job loss among the young and the unskilled as a result of a 30% hike in the state's minimum wage. Applying those findings to Baltimore City, where unemployment among those aged 16-24 is a devastating 31%, could lead to an unimaginable 37.5% unemployment rate. Beyond Baltimore City youth, the overall unemployment rates in Baltimore City, Washington county in western Maryland, and the counties of the lower Eastern Shore show that significant portions of the state simply could not absorb the job shock likely to be caused by a 40% wage hike.

The Governor and the folks at Raise the Wage estimate that over 500,000 workers would get a raise if the minimum were set at $10.10. With just under 3 million employed workers in the state that amounts to nearly 17%! That represents a significant new cost imposed upon businesses. How can anyone seriously think that employers will not respond by trimming hours, cutting positions, and refusing to hire the young and the less skilled? How can anyone believe that the state's high unemployment counties will be made better off?

Senate President Mike Miller has been less than receptive to the idea of a $10.10 statewide minimum. He has raised the possibility of allowing counties to set their own wages. Though that is certainly preferable to a statewide minimum of $10.10 per hour, I think a wage of $8.40 per hour, adjusted for inflation thereafter, is the best option for the state (and the country).

What I've not made clear is that I do not oppose raising the minimum wage. In fact, I think a review of the history of the wage suggests that it should be raised to approximately $8.40 an hour and then indexed to inflation thereafter. But the proposal to make the MD minimum $10.10 by 2016 simply goes too far and would likely have significant negative effects on youth and unskilled employment levels. Those advocating the $10.10 an hour wage like to claim that had the minimum wage in the late 1960s simply kept pace with inflation the wage today would be well be roughly$10.50 per hour. Unfortunately, those folks are being intentionally misleading.

In fact, a new Congressional Budget Office report puts the lie to most of the claims made in support of the $10.10 minimum wage. According to the report, such a wage hike would result in the loss of 500,000 jobs. Though the wage hike would theoretically inject $31 billion dollars into the economy, only 19% of that would benefit families living in poverty while 29% would benefit families earning three times the poverty level or more - this is because most of those earning the minimum wage are not in poor working families. But the $31 billion figure is actually meaningless. The CBO estimates that 93% of the $31 billion would be negated by lost income to businesses, lost income from the resultant job loss, and lost income due to higher prices caused by the wage hike. In Maryland, Martin O’Malley has argued that a $10.10 minimum wage would pump $456 million into the Maryland economy, but if the CBO estimates are accurate, that $456 million would actually be less than $30 million owing to job loss, higher prices and lost business income. As an alternative, the CBO considered a $9 minimum wage as well and noted far fewer negative effects.

Are Minimum Wage Earners Young and Childless or Working Parents?

The other justification for the $10.10 per hour proposal is that it would raise the income of a family of four, with a single parent working full time, to the poverty level. But this a dubious goal. The average family size in American is 2.6, not 4. At a recent town hall meeting in southern Maryland Senator Ben Cardin offered some less than helpful statistics regarding those earning minimum wage. He said that roughly 2/3 are women and the average age of an earner is 35. His intent was clearly to create the impression that most minimum wage earners are single Moms. This is not the case. Roughly 1/3 of low income families are in house holds with a single adult.

As to the average age, the statistics shows why social scientists have three measures of central tendency, 1) the mean or simple average, 2) the median or value at which half the observations are above and half are below, and 3) the mode or the most frequently observed value. Though most people are familiar with concept of an average, the measure can present a skewed picture. Imagine 10 people, 9 of them have $10 and one of them has $1,000. Calculating the average cash on hand is easy - $1,090/10=$109. Clearly that is not an accurate accounting of the group. The median and modal values would be $10 - more accurate. So, back to minimum wage earners - consider the average age of 35 and a working life of 16-65 years of age. There are 19 measurable years between 16 and 35, but there are 30 measurable years between 35 and 65. Because our working life excludes our first 15 years of life, the simple average age of a minimum wage worker would skew "old." Consider how difficult it is to reconcile the average age with this fact: one-third of those earning the federal minimum wage are teens, and just over half of minimum wage earners are under the age of 25. If just over half are 25 of younger it suggests the median age is approximately 24 years old. And one final point, the vast majority of minimum wage earners are not the sole source of income for a family. So suddenly the image of minimum wage earners as single Moms disappears. It is true that about 1/4 of minimum wage earners fall into the category of parents with children - but it's inefficient and poor targeting to implement a 40% wage hike for the 75% of wage earners who are no parents supporting a family just to provide an income boost to 25% - and a recent piece in the Baltimore Sun demonstrated that as a result of the wage hike, many of those in that 25% would lose eligibility for social supports and wind up with less net income.

Would the Inflation Adjusted Wage Really Be over $10 per hour?

The following graph, courtesy of the unbiased folks at Pew, shows that the period from the late 1960s through at least 1981 were an unusually "generous" period for the minimum wage. But the period was far from the norm. If one were to select the late 1940s or the late 1950s as the basis for today's wage in would be far below $10.50, below $10.10, and below the current level of $7.25 - so claims of an inflation adjusted $10 minimum wage are simply disingenuous. In the end, none of the main arguments for a $10 wage hold up to serious scrutiny.

Should the Wage Be Higher?

There is a case to be made that the inflation-adjusted average wage for the "generous" period should serve as a baseline for the wage moving forward. Without question, a concerted effort was made to increase the purchasing power of the minimum wage throughout the 1960s and 70s before a long slide began in the 1980s through until 2009. Boosting the wage to the 1960s and 70s level would yield a minimum wage for 2015 of approximately $8.40 per hour. If it were then indexed to inflation and automatically adjusted every year thereafter it would no longer go through long periods of decline followed by sudden increases. As result, it would provided some degree of predictability in the value of the wage to workers and the cost of labor to employers.

In a prior post I cited a New York study that estimated a 20% jump in job loss among the young and the unskilled as a result of a 30% hike in the state's minimum wage. Applying those findings to Baltimore City, where unemployment among those aged 16-24 is a devastating 31%, could lead to an unimaginable 37.5% unemployment rate. Beyond Baltimore City youth, the overall unemployment rates in Baltimore City, Washington county in western Maryland, and the counties of the lower Eastern Shore show that significant portions of the state simply could not absorb the job shock likely to be caused by a 40% wage hike.

The Governor and the folks at Raise the Wage estimate that over 500,000 workers would get a raise if the minimum were set at $10.10. With just under 3 million employed workers in the state that amounts to nearly 17%! That represents a significant new cost imposed upon businesses. How can anyone seriously think that employers will not respond by trimming hours, cutting positions, and refusing to hire the young and the less skilled? How can anyone believe that the state's high unemployment counties will be made better off?

Senate President Mike Miller has been less than receptive to the idea of a $10.10 statewide minimum. He has raised the possibility of allowing counties to set their own wages. Though that is certainly preferable to a statewide minimum of $10.10 per hour, I think a wage of $8.40 per hour, adjusted for inflation thereafter, is the best option for the state (and the country).